In his $6.8 trillion annual budget proposal to Congress, President Joe Biden called for $5 trillion in tax increases, surprising congressional lawmakers.

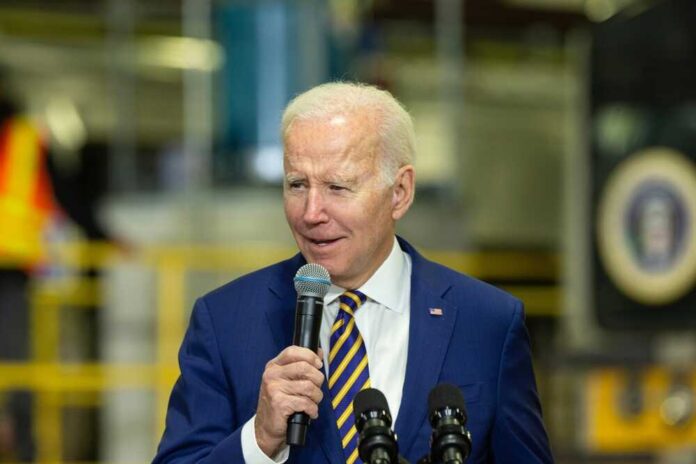

Biden announced the proposal while giving a speech in Pennsylvania: “My budget reflects what we can do to lift the burden on hardworking Americans, and there’s more than one way to do that,” Biden said in Pennsylvania. “And that’s — would bring us to, down to everyday costs: how much do things cost.”

According to The Hill, the unexpected proposal puts Democrats at risk in the 2024 election as Biden prepares for a re-election bid and his party attempts to defend 23 seats in the U.S. Senate, including seats in Republican-leaning states.

Republicans criticized the proposal, saying it will only worsen ongoing economic woes, including inflation and high tax rates.

BIDEN PROPOSES $5.5 TRILLION IN TAX INCREASES OVER DECADE

BIDEN BUDGET WOULD INCREASE DEFICIT TO $1.8 TRILLION IN 2024

— NewsWire (@NewsWire_US) March 9, 2023

Sen. Mike Crapo (R-ID) described Biden’s plan as “jaw-dropping” and said it is “exactly the wrong approach to solving our fiscal problems.”

Grover Norquist, president of Americans for Tax Reform, a group advocating for low taxes, said, “in dollar terms, it’s the largest tax increase in American history.”

In an interview with Newsmax host Chris Salcedo, Norquist said Biden’s proposed tax increase slows economic growth.

“[Taxes] remove money from the productive part of the economy, from small businesses and individuals, and hand it to the government, which is a monopoly,” Norquist said during “The Chris Salcedo Show” Friday. “And monopolies are inherently inefficient and don’t function very well. The larger the government, the slower the growth of the economy.”

In October 2021, Biden tried to negotiate with Sen. Joe Manchin (D-WV) on the Build Back Better agenda by proposing $2 trillion in tax increases.

Biden’s new proposal shocked some Democratic policy experts, who say it could be a negotiating tool rather than a demand.

“I didn’t expect to see a number that big, but I’m not alarmed by it,” said Jim Kessler, a spokesman for the Democratic think tank Third Way. “I think it’s a negotiating position.”

In his State of the Union address, Biden told Congress that his budget plan would lower the national deficit by $2 trillion, making wealthy Americans and big corporations “pay their fair share.”

Biden has called for a 25% tax on the nation’s wealthiest 0.01% of families, an increase in the corporate tax rate from 21-28%, and an increase in the top marginal income tax rate from 37-39%. He has also called for quadrupling the 1% tax on stock buybacks and taxing capital gains at 39.6% for people whose income exceeds $1 million.