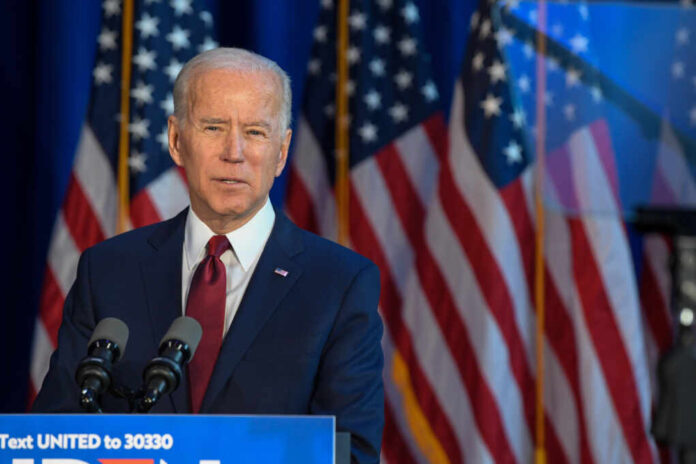

Amid an ever-diminishing economy because of President Joe Biden’s disastrous policies, Moody’s Investors Service recently cut its outlook on the U.S. credit rating to negative from stable, citing higher interest rates and the Biden administration’s inability and refusal to implement successful fiscal policies.

BREAKING: Moody’s Investors Service Changes Outlook on United States Credit Rating from ‘Stable’ to ‘Negative’, Citing Risks to Fiscal Strength & Political Polarizationpic.twitter.com/NplIHqaxcf

— Chief Nerd (@TheChiefNerd) November 10, 2023

Market Watch reported that a negative outlook signals a credit rating could potentially be reduced but doesn’t necessarily mean it will be.

Moody’s Investors Services blamed “continued political polarization” for its shift in credit rating.

“Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” the company said in a press release, as reported by the Washington Examiner.

Moody’s Investors Service still rates U.S. sovereign debt AAA, making the company just one of three major credit-rating companies to maintain such a rating on the world’s largest economy.

“The sharp rise in U.S. Treasury bond yields this year has increased pre-existing pressure on U.S. debt affordability,” the company said.

“In the absence of policy action, Moody’s expects the U.S.’s debt affordability to decline further, steadily and significantly, to very weak levels compared to other highly-rated sovereigns, which may offset the sovereign’s credit strengths explained below,” it added.

The U.S. Treasury Department wasn’t too fond of Moody’s Investors Services’ announcement.

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset,” Deputy Secretary of the Treasury Wally Adeyemo said in a statement.

Adeyemo continued, saying that the Biden administration’s proposed plans to reduce deficit spending in its June 2023 debt limit deal would put America on the right track, unlike Moody’s Investors Service suggests.

Moody’s Investors Service warned that its AAA rating on U.S. sovereign debt could come to an end if the company concludes that the Biden administration is unlikely to effectively respond to the ongoing fiscal challenges in America.

The company’s outlook change comes after Fitch Ratings downgraded the U.S.’s credit from AAA-AA+ in August 2023, citing the “steady deterioration in standards of governance over the last 20 years.”